The KSA Giga-construction boom was to follow the end of the Expo-FIFA driven project cycle. The pandemic, politics and macro-economics have unfortunately delayed the hand-over in this construction market relay and HVAC businesses that were shielded from the economic fallout of the gap in the project development during 2020 are now experiencing a painful market contraction.

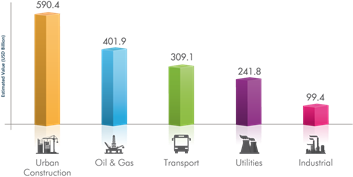

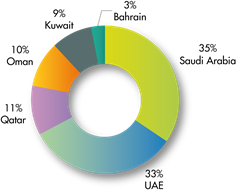

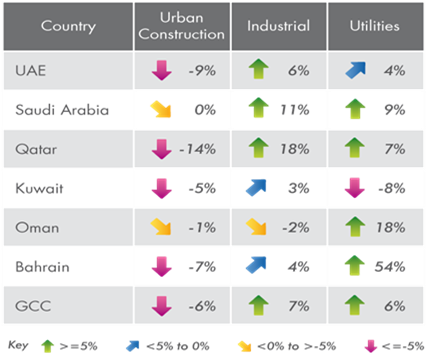

Even though the estimated regional spend planned for urban projects continues to be formidable at close to 582b USD, it had been reeling pre-pandemic with over capacity. The GCC’s urban construction project market has shrunk by 6% over the last 12 months with 91,8b USD worth of projects completed and 9b USD worth of projects cancelled, while only 24,3b USD in new construction were announced.

While there is no hiding from the short-term pain, there are multi-billion-dollar strong reasons to be optimistic about the mid-to-long-term prospects for construction in the region. Let’s evaluate three of the most relevant ones here:

- The Giga projects are real. While most HVAC businesses cannot reasonably forecast this work at present because of the lack of transparency to the activity that is taking place, it will be reassuring to know that many major consultants are overwhelmed with the design work that’s on their plates, mobilisations to site and early-stage work on projects like NEOM have begun. The most exciting opportunities for HVAC businesses today are the massive district cooling requirements that these developments are going to need.

- Utility growth is a canary in a coal mine. While the urban sector shrunk through the pandemic, the utility sector grew by 6%. This strong growth in utilities has been seen almost across the entire GCC and is an early indicator of the urbanisation and industrialisation of the region that is being planned for. It's also encouraging to see that the multi-billion-dollar utility infrastructure that is being built-out is not just government initiatives but also through PPP schemes which involve greater vetting of the viability of projects by financial institutions and the private sector.

- Making food, medicine, essential commodities & data locally. Covid has woken up governments and industrialists who realise that the sleepy pace of industrialisation can significantly affect stability and security. Industrial growth in the food processing sector and medical sectors are primary targets of the drive for economic and social security particularly for the UAE, Saudi Arabia, and Qatar, but aren’t the only industries that they are targeting as they work towards job creation in a post-covid world.

A good example would be the upcoming Food Tech Valley, a new initiative that seeks to triple the UAE’s food production and will be home to four main clusters: agricultural technology and engineering cluster, a food innovation centre, R&D facilities, and an advanced smart food logistics hub. The project is a part of UAE’s National Food Security Strategy 2051 aims to create an integrated modern city that will cater as a hub for future clean tech-based food and agricultural products and an incubator for researchers, entrepreneurs, start-ups, and industry experts involved in developing solutions that have the potential to shape the future of the food industry.

With a solid case to be made for the future, businesses must plan to take a breather while they prepare for the next construction boom.